Bp Statistical Review of World Energy Coal Consumption 1965-2015

Renewables were the largest source of new free energy in 2019, simply there were still record highs for oil, gas and CO2 emissions, co-ordinate to new global data from oil behemothic BP.

Low-carbon electricity generation also matched global coal power for the get-go time in 2019, analysis of the data shows. Farther gains for wind and solar drove make clean sources to this new milestone, helped by a historic autumn in coal output.

The 69th edition of the visitor's influential almanac statistical review of world energy is published amid a global pandemic that risks derailing global climate efforts, BP says. The firm joins a long list of others calling for a "greenish recovery" by saying the world should aim to "build dorsum meliorate".

The backdrop to all this is laid out in BP's new information, which describes a globe that was using tape amounts of energy in 2019, even though need rose more slowly than in the previous decade.

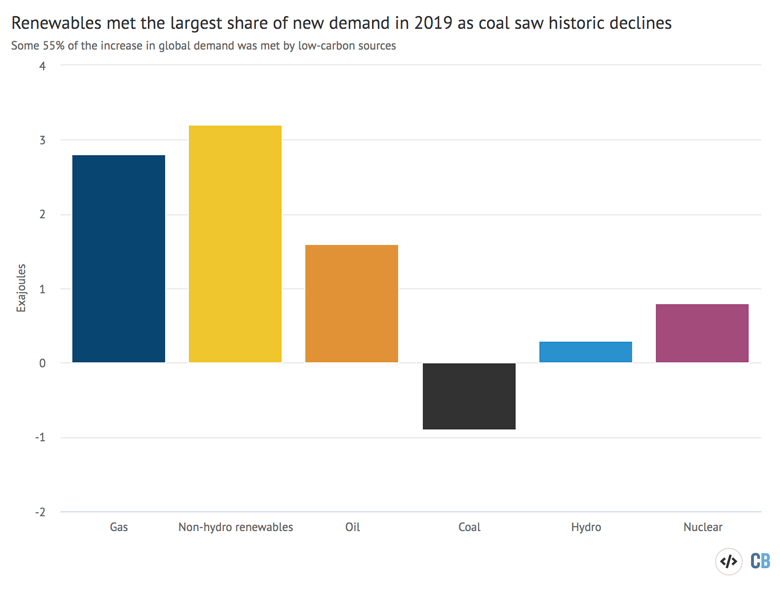

Renewables posted record growth in 2019 (3.ii exajoules, EJ, 12.2%) and though they met the largest share of rising need, a like portion was from fossil fuels. Large increases for oil (1.6EJ, 0.8%) and gas (2.6EJ, 2.0%) commencement falling coal use (-0.9EJ, -0.half dozen%).

As a upshot, global CO2 emissions rose again, albeit by just 0.5%, leaving the gap to global climate goals larger than e'er.

Hither, Carbon Brief runs through the cardinal details from this year'southward BP data.

Covid context and corporate repositioning

BP has been producing its annual statistical review since 1952 and it has been circulating in public since 1955. This year's 69th edition arrives at a time of grave global crisis, afterwards the loss of hundreds of thousands of lives to Covid-19 and the world's deepest recession since the 1930s.

It also coincides with BP's latest efforts to reposition itself as a company, post-obit the date earlier this year of new chief executive Bernard Looney. In February, the firm pledged to reach net-zippo emissions by 2050, a commitment Looney recently said was reinforced past coronavirus.

Simply this week, BP wrote down the value of its oil and gas reserves, due to a revised price outlook and the expectation of a faster shift away from fossil fuels. BP volition flesh out this expectation in its annual free energy outlook, which has been pushed back from April to September.

In a foreword to this week'south statistical review, Looney warns that the coronavirus crisis "risks slowing progress" on "long-term, global challenges, such as climate change". He adds that the world needs to respond to the pandemic "in a way that builds back better".

This echoes the linguistic communication coming from a diverse set of voices from the UN to the Pope, leading economists and many national leaders. Moreover, Looney says: "The technologies required to reach net zero exist today – the challenge is to use them at footstep and scale."

These changes in corporate rhetoric are accompanied by several small, but notable presentational changes in BP'south statistical review.

First, energy utilisation is now reported primarily in exajoules, a standard unit, rather than as "millions of tonnes of oil equivalent". Second, the tabular array presenting data on global CO2 emissions appears well-nigh the top of the report, as opposed to at the stop last twelvemonth. Third, biofuel apply is now counted with other renewable sources of free energy, as opposed to being included within the total for oil.

(One final change in this year's written report relates to the "input-equivalent ground" for converting non-fossil fuel outputs into amounts of primary free energy. This adjusts for the fact that most fossil principal energy is lost equally waste product heat. Refer to BP's methodology for more details.)

Slower growth before coronavirus

The new BP data shows global primary free energy demand having reached a new high in 2019 of 584EJ, upward by 7.7EJ or 1.3% on a year earlier. Three-quarters of the increase came from China. Overall, this means global free energy demand grew by the equivalent of the Uk or Mexican total.

The increase in 2019 was slower than the 1.six% boilerplate for the previous decade and, BP notes, just half the two.eight% rise in 2018. This slowdown is "in line with weaker economical growth and a partial unwinding of some of the one-off factors that boosted energy demand in 2018".

Some 41% of the increase in 2019 was met by renewables (3.2EJ), including wind, solar and biomass, making up the largest share of the total as the chart beneath shows. This was besides the largest-always annual increase for non-hydro renewables, breaking the tape from 2017.

Large hydro met 4% of the increase in new demand in 2019 (0.3EJ) and another 10% came from nuclear (0.8EJ), pregnant depression-carbon sources met 55% of the total.

Changes in the sources of global main energy supply between 2018 and 2019, in exajoules (EJ). Source: BP Statistical Review of World Energy 2020. Nautical chart past Carbon Brief using Highcharts.

Fossil fuels yet met much of the new demand in 2019, all the same, with 36% from gas (ii.8EJ) and another 21% from oil (ane.6EJ). Coal apply fell past 0.9EJ subsequently historic declines in the power sector.

Interestingly, the increases in nuclear and fossil energy need were relatively concentrated, whereas renewables posted increases beyond a much wider geographical spread.

China accounted for more than four-fifths of the increment in global oil demand in 2019 and India another fifth. China also deemed for three-fifths of the increment in nuclear energy output. For gas, both China and the U.s.a. made upward effectually a third of the increase.

In contrast, renewables growth came from Cathay (26%), the European union (18%), the U.s.a. (x%) and Nihon (7%), too as a host of other countries including Brazil (vi%), Indonesia (4%) and Mexico (4%).

Record share for low-carbon sources

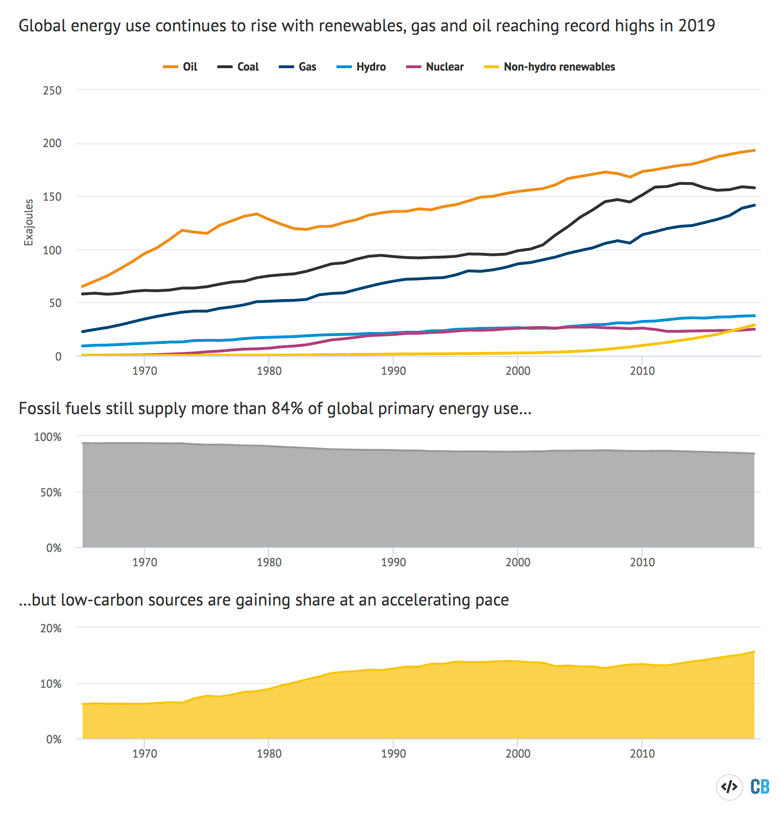

Global primary energy need has increased by fifty% over the past ii decades and is now double the level seen 40 years ago. This growth is intimately connected to rising CO2 emissions, as – unlike in 2019 – it has historically been largely met by fossil fuels.

In 2019, virtually energy sources continued to rise, with oil, gas, hydro and non-hydro renewables all reaching record highs, as the nautical chart below shows. The stand-out exception is coal, which has seen failing demand in four of the past six years and remains well below a 2013 peak.

Top panel: Global energy use by source between 1965 and 2019, exajoules (EJ). Lower panels: Fossil fuel and depression-carbon shares of the global free energy mix over the same period, %. Source: BP Statistical Review of World Free energy 2020 and Carbon Brief analysis. Chart past Carbon Brief using Highcharts.

Renewables were over again the fastest-growing source of energy, upwards 12% in the by year and a massive 252% in a decade. This explains the growing share of global energy demand being met by low-carbon sources, which, at nearly 16% in 2019, was the highest in the 54-year BP information series.

However, fossil fuels however met more 84% of global main energy demand in 2019. Although this is barely lower than their 86% share in 1999 or 88% in 1989, it is worth adding that the charge per unit of change is increasing, with fossil fuels losing one-half a per centum point in the past twelvemonth. (The shift is probable to exist even larger in 2020 given the fallout from coronavirus.)

Both oil (+0.eight%) and gas (+two.0%) posted continued growth in 2019, admitting at slower rates than in previous years. Global oil need is at present fifteen% higher than a decade ago, while gas use is up by 34% over the same period.

Coal use was down again in 2019 (-0.6%), the fourth drop in vi years. Yet information technology remains broadly level over the past decade, whereas it would demand to plummet to run across global climate goals.

CO2 emissions rose slightly

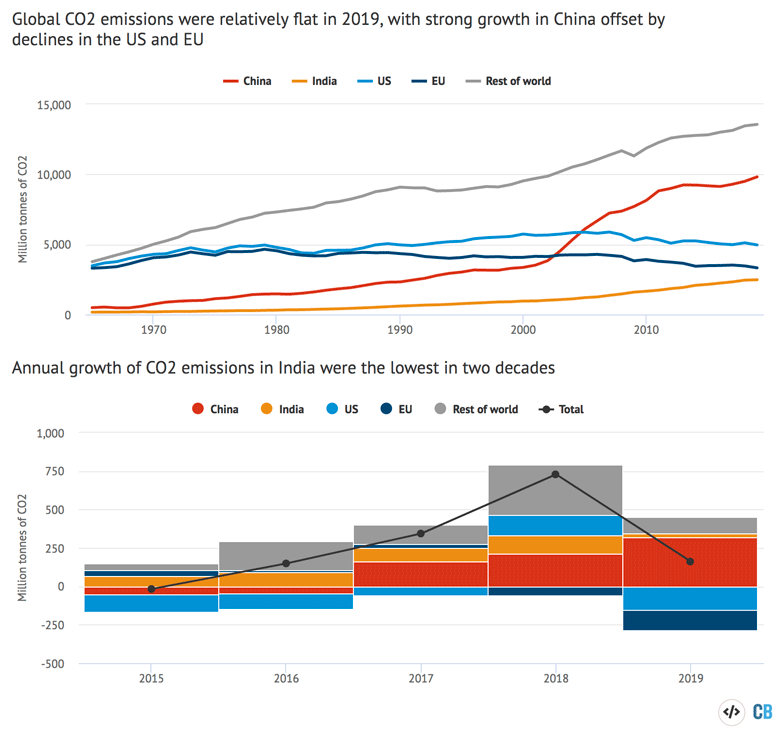

The latest small decline in coal was bereft to offset the increase in CO2 emissions from oil and gas, meaning the global total rose slightly in 2019, by 0.5%.

(Note that BP's methodology and coverage of CO2 emissions differs somewhat from that used by the International Energy Agency or the Global Carbon Project, which have both reported emissions in 2019 as having been more than or less flat relative to 2018.)

Of the 161m tonnes of CO2 (MtCO2) increase in emissions reported past BP for 2019, the largest commuter was once again gas, which accounted for roughly 4-fifths of the total. Ascent oil use was responsible for around iii-fifths of the increase in emissions, with coal offsetting the difference.

The chart beneath breaks down those global emissions by country, showing a sharp increase in China'due south CO2 output last twelvemonth. (Note again that the 3.four% increase in 2019 for People's republic of china, every bit reported by BP, is much larger than the two.0% approximate from the Global Carbon Project.)

China'southward contribution to global CO2 growth in 2019 is even more obvious in the lower console, below, where its 319MtCO2 add-on to the total (ruby) is partly offset past the declines in the US (-152MtCO2, calorie-free blue) and the EU (-136MtCO2, dark blueish).

In a higher place: Global energy-related CO2 emissions between 1965 and 2019, broken downward past key countries and regions, millions of tonnes of CO2. Below: Annual changes over the past five years, millions of tonnes of CO2. Source: BP Statistical Review of Globe Energy 2020 and Carbon Cursory assay. Nautical chart past Carbon Brief using Highcharts.

Also notable in the lower panel of the chart is the slow growth in CO2 emissions in India last year (28MtCO2, orangish). As Carbon Brief reported in May, Bharat's emissions barbarous for the commencement time in 4 decades in the financial year to March 2020, with a slowing economy during 2019 a central factor.

Without the increase posted by China, Indonesia and Vietnam during 2019, global CO2 emissions would certainly accept fallen, given the big declines in Europe and North America.

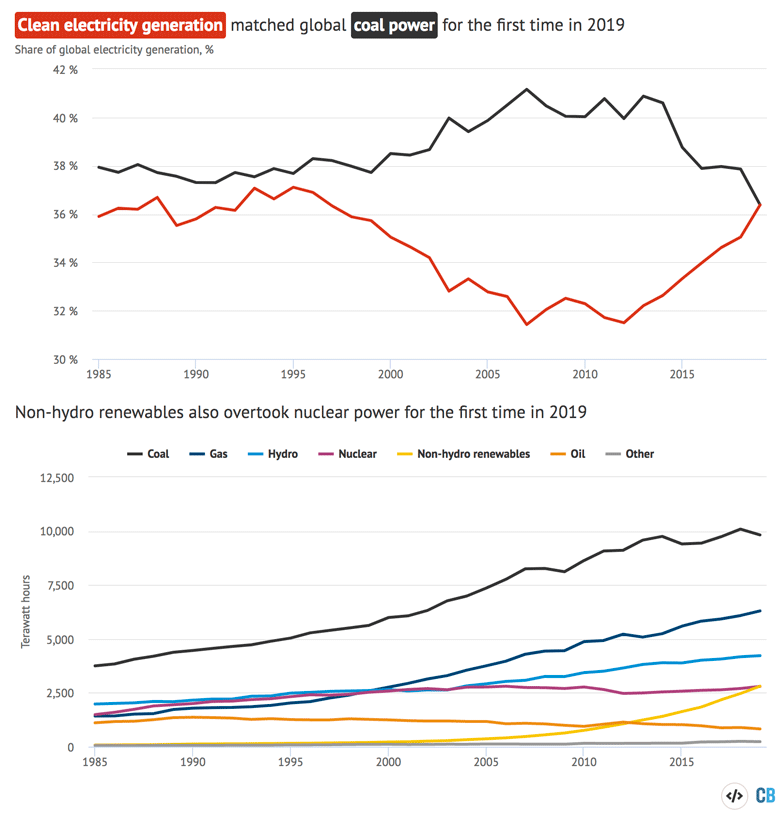

Clean electricity matched coal

Ane of the most striking nuggets buried in the BP data is the fact that depression-carbon sources of electricity matched coal power for the showtime fourth dimension in 2019, equally shown in the nautical chart below.

Make clean ability – including nuclear, hydro, current of air, solar, biomass and geothermal – had come close to reaching this point early on in the BP series, thanks to the rapid growth of nuclear. Merely coal had surged ahead during the 2000s equally a result of Prc's massive coal-fueled economic boom.

The new milestone for depression-carbon electricity stems from historic declines in coal power final year and shown in the lower nautical chart, below (blackness line), combined with continued rapid gains for wind and solar (with biomass and geothermal equally non-hydro renewables, yellow).

Top: Share of global electricity generation from low-carbon sources (red) and coal (black), 1985-2019. Bottom: Global electricity generation by source over the aforementioned period, terawatt hours. Source: BP Statistical Review of World Free energy 2020 and Carbon Brief assay. Chart past Carbon Brief using Highcharts.

Notably, despite a relatively strong 3.5% increment for nuclear ability output in 2019, it was overtaken for the starting time time past non-hydro renewables.

In total, global electricity output rose by a relatively modest 1.3% in 2019, reflecting the aforementioned drivers that kept energy demand in check. Alongside the 3% refuse for coal there were rapid gains for air current (thirteen%) and particularly solar (24%).

Low-carbon sources grew by more than than the total increment in electricity demand, adding 484 terawatt hours (TWh) with the uptick from gas (215TWh) more than offset past declines for coal (-267TWh) and oil (65TWh).

Fossil fuels fell to their joint-lowest share of the global total, at 63%, matching the previous low seen in 1988.

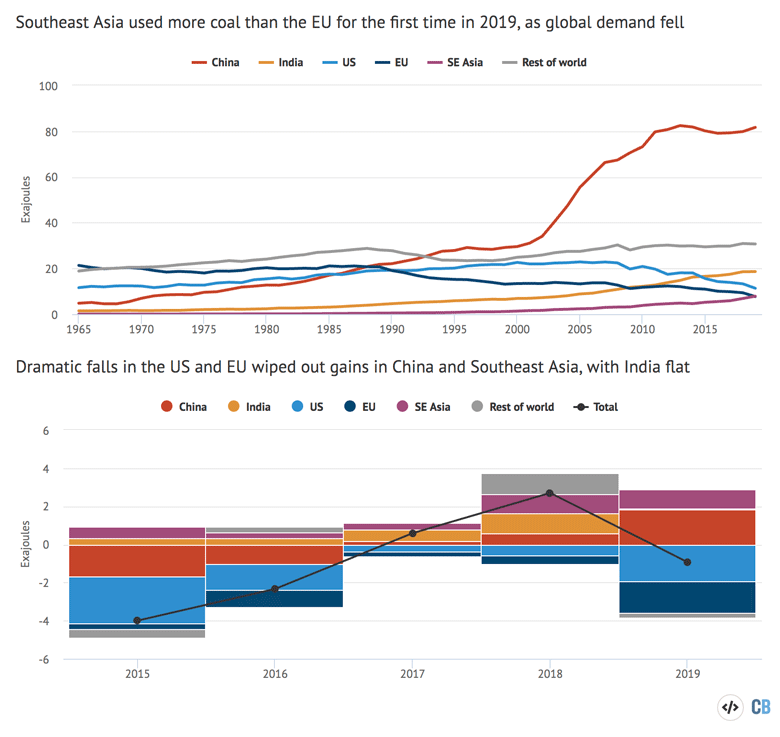

South-east asia overtook EU coal apply

Coal use for electricity generation is the major driver of overall demand for the fuel. And, as the chart below shows, the time to come trajectory of global coal employ depends on the rest between rise demand in Asia and the decline of coal in Europe and North America.

By the time China started its coal-fuelled nail in the 2000s, it was already the world's single-largest user of the fuel (red line). Growth in Republic of india (orangish) has been much less dramatic, overtaking the EU in 2009 (dark blue) and and so the United states only in 2015 (calorie-free blue).

Now, for the first time in 2019, the European union's coal demand has also been overtaken by that of south-e Asia (purple), where consumption rose by 14% last year. This leapfrogging has been aided past declines in European union coal use, down another 18% last year, while the Usa also saw a 15% fall.

Top: Global coal apply past country and region, 1965-2019, exajoules. Bottom: Annual alter in need for the same geographies over the past five years, coloured bars, and the global total, blackness line. Source: BP Statistical Review of World Energy 2020 and Carbon Brief assay. Chart by Carbon Brief using Highcharts.

Southward-east Asia'a two major users, with the fastest-growing fleets of coal-fired ability stations, are Indonesia and Vietnam, where demand increased by 20% and 30% in 2019, respectively.

Nevertheless, the future trajectory of coal all the same depends first and foremost on Cathay, where internal fence continues over whether to build hundreds of new coal plants during the adjacent five-year plan.

Whatever expansion of Chinese coal capacity would come despite extensive overcapacity and fiscal distress in the sector, the country's ain climate targets, plus the fact that a renewable-led electricity system would cost less money, according to recent research.

Recent moves by Beijing are the first signs of central authorities pushback against provincial plans to greatly aggrandize coal capacity, simply the debate is far from settled.

Republic of india'southward plans to continue growing its ain coal fleet face similar challenges, with the sector having taken the burden of reduced demand – and lower revenues – during the coronavirus lockdown. Hither, too, there is potent internal fence over whether to back up the coal industry or not.

Source: https://www.carbonbrief.org/in-depth-bp-data-reveals-clean-electricity-matched-coal-for-the-first-time-in-2019

0 Response to "Bp Statistical Review of World Energy Coal Consumption 1965-2015"

Post a Comment